It’s Just an Experience (WT501)

Blog

I recently travelled to Orlando, Florida to graduate as a Transformational Mindset Facilitator for David Bayer’s Phenomenal Coaching Methodologies – in other words Mindset 2.0 but that’s not what I want to talk about. I just want to give you the context for this week’s thought.

On my return flight from Orlando to Los Angeles I was waiting in line at the Security Checking stations. I wasn’t paying attention and like a sheep, I simply followed behind the people in front of me, until …. a hand waved in front of my face, gesturing that I should move back behind a sign (that I hadn’t seen).

“Step back”, he yelled. “Ma am, read the sign. It says ‘Wait here until I call you’. I’ve got two lines to check and you have to wait.”

Inside I was fuming. I was embarrassed. My heart was racing and I could feel myself blush the colour of a ripe red tomato from my neck to my forehead. I went into what we call a Primal State.

I did as I was told. I know better than to upset the American Security Guards, especially at an airport.

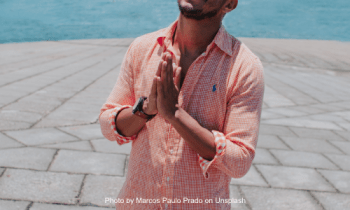

As I stood there, I remembered my training from David Bayer; it’s only an experience. There is no suffering in the experience, only the meaning we give it, so I decided to let it go. There was no need to make anything more of it. Let it go.

We have hundreds of experiences every day. We don’t need to attach meaning and suffering to something that is over.

With that I carried on with my journey home and entertained myself with positive happy thoughts of my reunion with Ross and visualised the things I want to create in my life.

I would be silly to waste my energy on the negative and cut myself off from the creative inspiration and infinite intelligence, that is only available when we are in, what we call, a Powerful State.

How about you?

Would you have carried it or let it go, realising it is just an experience?

There is no suffering in any experience; only the meaning we attach to it.

Your challenge this week, and every day of your life, is to maintain living in the Powerful State rather than the Primal State. (Just to clarify, from David Bayer – the Powerful State aligns to the parasympathetic autonomic nervous system which is rest and relaxation.)